Since COVID-19 was declared a global pandemic on March 11, businesses have had to reckon with its economic impact for over a full quarter.

For the last several months, we've been publishing weekly cuts of data on core performance metrics, to provide business owners with useful benchmarks as they adapted to circumstances that were changing by the day.

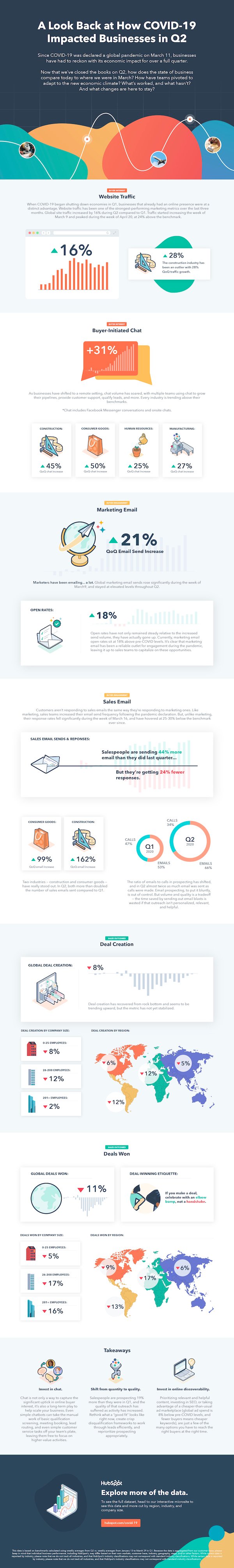

Now that businesses have closed the books on Q2, we wanted to take a step back and assess where our customers are, four months later. How does the state of business compare today to where it was in March? How have teams changed their behavior to adapt to the new economic climate? What's worked, and what hasn't? And what changes are here to stay?

This retrospective takes a deep dive into buyer interest, marketing and sales outreach, and sales outcomes (spoiler alert: there's a lot of engaged prospects out there, but sales teams have work to do in capturing that interest). We examine how different industries, regions, and company sizes have been impacted by COVID-19, and offer suggestions for investments that make sense right now.

HubSpot can't make predictions about what will happen, and nobody knows what the future looks like. But we hope this report from our customer base provides a helpful reference as businesses enter the next quarter, and that the insights are useful to you in some way. To explore the accompanying dataset on your own, you can find our interactive microsite here.

This data is based on benchmarks calculated using weekly averages from Q2 vs. post-holiday weekly averages from Q1. Because the data is aggregated from our customer base, please keep in mind that individual businesses, including HubSpot's, may differ based on their own markets, customer base, industry, geography, stage, and/or other factors. While certain data is reported by industry, please note that we do not track all industries, and that HubSpot’s industry classifications may not correspond with standard industry classifications.

What We're Seeing Today: A Q2 Snapshot

When COVID-19 began shutting down economies in Q1, businesses that already had an online presence were at a distinct advantage. The data shows steady and sustained growth in buyer engagement, and that businesses with an online presence were ready to capture that interest.

The story gets a little murkier once buyers actually start to engage with companies. Marketing teams have risen to the challenge of keeping prospects interested in a messy, chaotic crisis and met an audience of buyers who suddenly spend all day at their computer. While email volume has risen significantly — typically a no-no for teams hoping to keep their open rates up — open rates have risen faster than volume has grown, demonstrating that teams have been successful at providing relevant and helpful content.

On the sales side, things aren't going so well. We at HubSpot are wholly empathetic to the uncertainty of buyers everywhere and the stressful situation salespeople work in right now — and that stress has been reflected in an explosion in prospecting activity. Sales teams sent up to 60% more email than pre-COVID benchmarks. But response rates have been dismal. Marketing teams have been able to connect, but sales teams haven't. This is a huge area of opportunity for businesses as they enter the next quarter of COVID-19.

How COVID-19 Impacted Businesses in Q2

1. Buyer Interest

Site Traffic

Website traffic has been one of the strongest-performing marketing metrics over the last three months. As buyers have moved their purchasing online out of necessity, businesses with an established digital presence have reaped the rewards. Global site traffic increased by 16% during Q2 compared to Q1. Traffic started increasing the week of March 9 and peaked during the week of April 20, at 24% above the benchmark. The metric then settled in the 15-20% range throughout May and June, and currently sits at 20% above the pre-COVID benchmark. Since we saw a similar drop for this metric at the end of Q1, we hope that site traffic will rebound again in July.

With the exception of last week, construction is one of the few industries where website traffic has risen consistently, increasing by 28% since Q1. In fact, traffic to construction websites was almost 50% above the benchmark at the start of June, before coming down a bit later in the month. Computer software followed a similar trend until late April; its positive momentum stalled during May, but rose again in early June. Both industries plateaued last week, but are still trending around 40% above the benchmark.

All other non-structurally impacted industries are following the global trend at just above or below the benchmark. But this average is a tale of two pandemics — some industries are overperforming, while others are lagging far behind. Industries like human resources and manufacturing are seeing similar traffic patterns to pre-COVID, and have remained consistent throughout May and June. Travel, an industry that was structurally impacted by COVID-19, has recovered a remarkable 40% since the week of March 30. Its site traffic is now just below the benchmark at -1%.

Customer-Initiated Chat

Since the business world has suddenly shifted to a remote setting, chat volume has soared. Sales teams have pivoted to chat to grow their pipelines, while customer service teams are leveraging this medium to manage the increased demand for support.

With the exception of two weeks, chat volume has steadily risen week-over-week since the beginning of March, peaking at 45% above the benchmark in late-May. Total chat volume in Q2 outpaced Q1 by a notable 31%. As restrictions on businesses continue to be lifted around the world, it'll be interesting to see if chat volume maintains this steady growth.

Every industry is trending above the benchmark when it comes to live chat. This is a positive sign that buyer interest is increasing, and that people are engaging with companies more frequently. The industries that have seen the strongest performance in Q2 are construction, consumer goods, human resources, and manufacturing, which all grew by 25% or more during this last quarter. Consumer goods and construction were certainly outliers in Q2, with both industries seeing a bump of 45-50% in volume.

2. Buyer Engagement

Email Marketing

Global marketing email sends rose significantly during the week of March 9, and stayed at elevated levels throughout Q2. Marketers sent 21% more emails during Q2 than Q1, and email sends have recently peaked at 36% above the benchmark during the week of June 15. This elevated volume is the basis for one of this report's most surprising findings — open rates have not only remained steady relative to the increased send volume, they have actually gone up. The world has only gotten noisier since COVID-19 shut down business as usual, so this is a real testament to marketing teams that have been able to remain relevant and top-of-mind in a stressful time.

Email open rates have hovered around 10-20% above the benchmark throughout Q2. Currently, marketing email open rates sit at 18% above pre-COVID levels. It's clear that marketing email has been a reliable outlet for engagement during the pandemic, leaving it up to sales teams to capitalize on these opportunities.

It's also interesting to see how companies of different sizes pivoted their approach to email marketing during COVID-19. For instance, companies with 0-200 employees experienced the most growth in terms of marketing email sends during the past few months. In Q2, 0-25 employees grew 31% compared to Q1 and 26-200 grew 21%. Companies with 201+ employees sent 14% more emails in Q2, and currently this metric sits at 23% above the pre-COVID benchmark.

Even as open rates reached unexpected highs, one rule of marketing email remained true — companies that sent less email got more opens. Companies with 201+ employees had the smallest increase in email volume, and saw consistently higher open rates, currently performing 25% above the benchmark at the end of Q2. 0-25 and 26-200-employee companies also showed a strong end of June, with open rates roughly 15% above benchmark. These numbers are likely trailing behind larger companies because 0-200 employees are sending a lot more emails to a smaller customer base.

All the industries we're tracking seem to be following the same global trend for marketing email sends, with the exception of human resources, which is sending 81% more email than pre-COVID levels. However, open rates have been quite volatile since late March, calling into question how effective their strategy has been. Right now, open rates for human resources are trending 4% below benchmark, consistent with the maxim that companies should be using email to communicate with customers, but not overusing it to the point where it's ineffective.

Sales Emails

If Marketing's job is to identify buyer interest, Sales is responsible for finding the prospects in that pool who will eventually become customers. While sales outcomes are improving (more on this later), sales prospecting has fallen short of its potential.

The number of emails sent by sales teams experienced an immediate and dramatic uptick following the pandemic declaration. From early-March to late-April, sales teams pushed hard to generate pipelines, leading to a 42% increase in email volume. Compared to Q1, sales teams sent 44% more email in Q2. Today, global sales email volume is at an eye-popping 59% above the pre-COVID benchmark.

The problem is that customers aren't responding to sales emails the same way they're responding to marketing ones. Like marketing, sales teams increased their email send frequency following the pandemic declaration. But, unlike marketing, their response rates fell significantly during the week of March 16, and have hovered at 25-30% below the benchmark ever since.

Response rates dropped 24% in Q2, even as email volume fluctuated throughout the quarter. As sales teams increased email sends, customers began to tune these messages out or even mark them as spam in their inboxes. So far, it seems if email send rates remain this high, we can expect response rates to trend in the opposite direction.

Two industries — construction and consumer goods — have really stood out. In Q2, both more than doubled the number of sales emails sent compared to Q1, are still well above the benchmark despite some decline in volume during June. Their response rates have been correspondingly lower than the global decrease, with both industries receiving 33% fewer responses in Q2 than Q1.

These trends tell an important story. Email prospecting, to put it bluntly, is out of control. It's easy to send thousands of emails with just a few clicks, and in a chaotic time, we understand why sales teams are sending so many. But volume and quality is a tradeoff — the time a team saves by sending out email blasts is wasted if that outreach isn't personalized, relevant, and helpful. These gaps are clear in the data. At this point, sales teams should be working closely with marketing to understand how they can improve their email engagement rates, and sending far less email.

Call Prospecting

As both marketing and sales email volume went up globally, call prospecting plummeted, falling to a low of 27% below the benchmark by the week of April 6. This has been trending upward since, as call events are now at 9% below pre-COVID levels. However, the total number of prospecting activities (email and calling) has increased by 19%, and the shifting ratio between calling and emailing is revealing. In Q1, the ratio was closer to 1:1 while in Q2, sales people sent more than twice as many emails as they made calls. Sales teams will need to return to their pre-COVID balance in order to see improvements in response rates.

All regions have demonstrated overall positive momentum since the week of April 27. EMEA is the furthest below benchmark at -18%, while NORTHAM and APAC are close to pre-COVID levels, trending at 6-7% below the benchmark. LATAM is currently the closest to the benchmark at -2%, following a recent rise in call activity in June. We hope to see these numbers continue to trend in a positive direction as we move into the start of Q3.

3. Sales Outcomes

Deal Creation

New deal creation took a nosedive in March, as companies paused "business as usual" to understand what cutbacks and operating changes they'd need to weather the pandemic. Globally, the number of new deals created was at its lowest point the week of April 6, where 30% fewer deals were created compared to pre-COVID levels. Overall, the number of deals created in Q2 is 8% less than the number of deals created in Q1, and this trend is reflected in all regions and company sizes.

More recently, this metric has been on an upward trajectory globally, though this growth has been volatile. In the 11 weeks since April 6, eight weeks have seen week-over-week growth in deal creation, while three weeks have seen week-over-week decline. The number of deals created have increased for each of the last four weeks, and businesses are hoping that this trend will hold.

All regions are trending positively and are re-approaching pre-COVID levels. APAC, the region that was first impacted by COVID-19 and has to date been relatively successful at containing the virus' spread, created 5% fewer deals in Q2 than in Q1. North America created 6% fewer deals in Q2, and EMEA and LATAM trail the group at 12% below Q1 averages.

All company sizes are on a similar upward trend, though none have returned to pre-COVID levels. Companies with more than 200 employees are leading the pack, creating just 2% fewer deals in Q2 than in Q1. Compared to Q1, companies with 0-25 employees are down 8%, and companies with 26-200 employees are down 12%.

Unsurprisingly, deal creation cut by industry is seeing the most variability. Travel and entertainment, the two most structurally impacted of the industries we're tracking, are still far below pre-COVID benchmarks (35% below and 27% below, respectively). Consumer goods is 11% below benchmark, human resources is 10% below benchmark, and computer software is 3% below benchmark. The two industries that are outperforming pre-COVID levels are manufacturing (6% above) and construction, a whopping 36% above benchmark.

Deals Won

Globally, the number of deals won is trending upward as well, and was 8% above benchmark the week of June 22. Like deal creation, this metric has been highly variable since its lowest point — also the week of April 6, when it was 36% below pre-COVID benchmarks. Deals won has seen week-over-week increases for 10 out of the last 11 weeks.

When comparing Q2 to Q1, this metric lagged slightly behind new deals created in its climb toward pre-COVID levels. There were 11% fewer deals won in Q2 compared to Q1, with variability among regions, industries, and company sizes balancing out to that number. As deal creation is a leading indicator of future revenue, this trend is to be expected.

By region, APAC has made the best recovery, with only 6% fewer deals won in Q2 than in Q1. EMEA is the farthest behind at 17% fewer deals won in Q2, while LATAM and NORTHAM are on par with each other at 13% and 9% below Q1 volume, respectively.

Companies with 0-25 employees are closest to Q1 volume, at only 5% fewer deals won in Q2. Companies with 26-200 employees won 17% fewer deals in Q2 than in Q1, while companies with 201+ employees won 16% fewer deals.

As with deal creation, deals won is the most variable when viewed through an industry cut. Four industries are closing more deals than pre-COVID, while three are still far below. Here's how each industry we're tracking shakes out:

Above pre-COVID benchmarks:

- Construction: 24% above benchmark

- Computer software: 14% above benchmark

- Manufacturing: 13% above benchmark

- Consumer goods: 8% above benchmark

Below pre-COVID benchmarks:

- Human resources: 20% below benchmark

- Entertainment: 21% below benchmark

- Travel: 29% benchmark

Perhaps more than any of the other metrics covered in this piece, the long-term health of both deal creation and deals won wholly depends on how the biological reality of the pandemic unfolds. It's also important to remember that this data should be viewed not as a commentary on the overall health of the economy, but rather as a snapshot of how businesses are behaving right now. Because our data is pulled from HubSpot customers, it is not reflective of the entire economy and does not capture the economic circumstances of any individuals or HubSpot's own business.

Takeaways

1. Invest in chat.

As many businesses move online for the first time, live chat numbers have skyrocketed in a few industries: construction, consumer goods, and manufacturing. The next few months of the pandemic are, by all expert accounts, uncertain. But we can say that there will be a significant change in how structurally affected industries operate in the future. Many companies who have transitioned online recently will remain online in the future, and this is an investment businesses will be thinking seriously about.

Investing in chat is not only a way to capture the significant uptick in online buyer interest, it's also a long-term play to help scale your business. Even simple chatbots can take the manual work of basic qualification screening, meeting booking, lead routing, and even simple customer service tasks off your team's plate, leaving them free to focus on higher-value activities.

Resources to Help:

- Learn how chat should and shouldn't work in this blog post

- Get up to speed with this beginner's guide to conversational marketing

- Learn how marketers are using conversational marketing in 2020

- Get your sales team started by learning how to add live chat to your website

Free Software to Get Started

- Free conversational marketing tools are included in HubSpot CRM

- Facebook Messenger integration with HubSpot

2. Shift prospecting away from quantity and toward quality.

The ratio of call prospecting to email prospecting was almost 1:1 before the pandemic. Now it's closer to 1:2. But response rates are historically low for the non-holiday season, a disconnect between marketing and sales performance that cannot be explained purely by the economic downturn. Salespeople are prospecting 19% more than they were in Q1, and the quality of that outreach has suffered as activity has increased.

Calling is inherently a forcing function in quality sales prospecting. It's almost not worth it to get on the phone unless you do some research, and that background is key to building rapport, qualifying (and disqualifying), and connecting with buyers. In the age of COVID-19, your entire qualification framework should change — a product that would never have been considered pre-pandemic could be business-critical today, and vice versa. Rethink what a "good fit" looks like right now, create crisp disqualification frameworks to work through leads efficiently, and reprioritize prospecting appropriately. Sales should also be borrowing tactics from marketing -- personalization through content, adding a personal touch through video, and prioritizing help over selling.

This ratio also reveals a broader principle sales leaders would do well to remember. Part of sales will always be a volume game, and it's pointless to deny that. Adopting automation and software cuts down on the time the team has to spend manually sorting leads, and frees them up to feel secure in taking a slower approach to prospecting. Prospecting must be worked from an individual and an operational perspective, and can't succeed without investment in both processes.

Resources to Help:

- Use these prospecting strategies to find new channels to engage your prospects

- These phrases that top salespeople use can help your team build customer rapport

- Watch the replay of our Adapt 2020 webinar on selling through uncertainty

- Refresh your email outreach with these sales templates

- Start using video in your sales outreach to engage more prospects

- Use this guide to increase your sales close rates

- Lead with empathy in sales emails to build rapport and increase response rates

- Equip your team with these essential inside sales technologies

- Streamline your sales process with this guide to frictionless selling (and this course)

Free Software to Get Started

- HubSpot CRM is free and comes with included advertising and sales acceleration tools, including free 1:1 video, meetings, and chatbot tools

- Gmail and Google Calendar integrations with HubSpot

- Zoom integration with HubSpot

- LinkedIn Sales Navigator integration with HubSpot

- Check out what HubSpot's app partners are offering at this time with this list of relief initiatives

3. Invest in online discoverability.

As a company that sells software to help businesses grow online, we're witness to a unique moment for our industry. Huge numbers of businesses and buyers shifted online out of necessity, many for the first time. Because this data is reflective of our customer base, which contains companies that have chosen to invest in their online strategy, we don't have a clear picture of what these numbers look like for businesses that are still 100% offline. But one thing is clear: Businesses that already had an online presence in March were at an advantage.

For most of us right now, our business's online presence is our business. Whether it's through a website, a landing page, or a business run through social media, buyers need to be able to find you online. Prioritizing relevant and helpful content, investing in SEO, or taking advantage of a cheaper-than-usual ad marketplace (global ad spend is 8% below pre-COVID levels, and fewer buyers means cheaper keywords), are just a few of the many options you have to reach the right buyers at the right time.

For businesses that do not already have online presences, it may seem intimidating to think about building a website. But the ubiquity of CMS software in 2020 means that it's possible to stand up a simple site in half a day, for free. And social accounts take even less time. There's no one-size-fits-all solution — if a website is too daunting right now, it's perfectly fine to start with just one account and go from there. Any move to online will be more valuable than relying exclusively on analog methods of growing your business.

Resources to Help:

- Create an effective SEO strategy using this helpful guide and template

- Prevent traffic loss altogether using this guide to predictive SEO

- Use this editorial calendar template to plan educational content

- Get started writing with these blog post templates

- Optimize content and get found online with our guide to SEO

Free Software to Get Started

Sign up for this week's webinar for more insights surrounding our three-month COVID-19 retrospective.

from Marketing https://ift.tt/2AG1LPo

No comments:

Post a Comment