The economic impact of COVID-19 is undeniable. Businesses all across the globe are learning how to adapt to these new circumstances and we're all learning how to operate in a "new normal" that's constantly changing.

That's why we'll be publishing week-over-week trend data for core business metrics like website traffic, email send and open rates, sales engagements, close rates and more. We hope to establish useful benchmarks to measure your business against, and serve as an early indicator of when short- or long-term adjustments may be needed in your strategy.

While this post focuses on the highlights of last week, you can explore all the data we're publishing here.

About the Data

- These insights are based on aggregated data from over 70,000 HubSpot customers globally.

- The dataset includes weekly trend data for core business metrics in 2020, focusing on changes occurring during and after March 2020.*

- Charts depict the performance of a given metric against pre-COVID benchmarks, calculated using weekly averages from January 13, 2020, to March 9, 2020. They do not depict week-over-week percentage changes.

- Because the data is sourced from HubSpot's customer base, it reflects benchmarks for companies that have invested in an online presence and use inbound as a key part of their growth strategy.

*The spread of COVID-19 has had a different timeline in different regions, so we are using the World Health Organization's declaration of a global pandemic on March 11, 2020 as our "official" start date.

NOTE: Because the data is aggregated from HubSpot customers' businesses, please keep in mind that individual businesses, including HubSpot's, may differ based on their own markets, customer base, industry, geography, stage, and/or other factors.

What We're Seeing

This week, we've gathered the top insights from our COVID data which now includes a breakdown for seven different industries. In the sections below, we'll provide you with your weekly metrics update, some notable industry insights, and how metrics are fairing in countries and regions around the world.

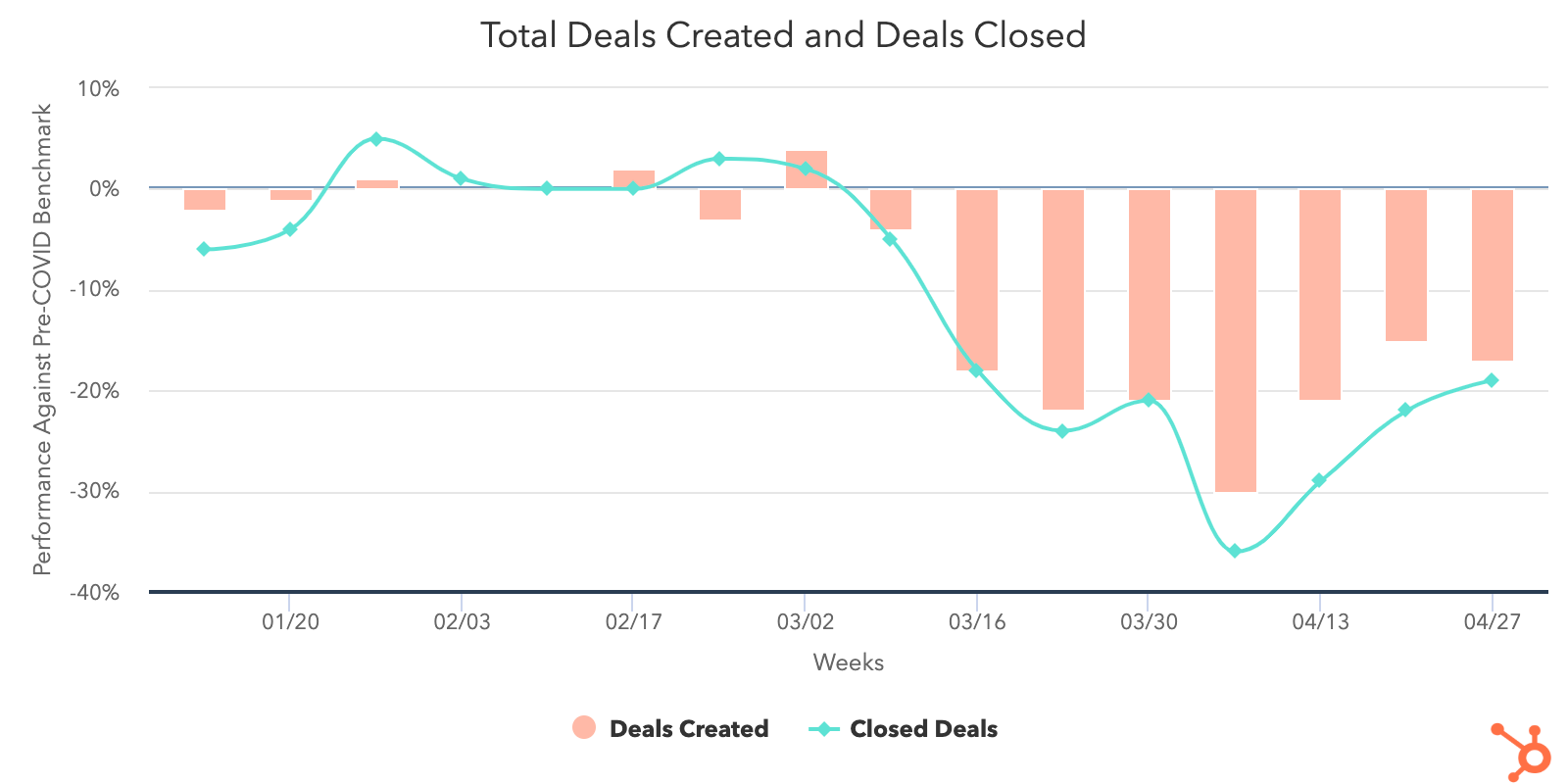

1. Deals closed show signs of recovery after a low in early April.

Last week was end-of-month for sales teams, and we saw deals closed increase by 4%. With that boost, our customers closed more deals the last week of April than they had since the week of March 16 when the economy really began to deteriorate. This was a hopeful sign of recovery that indicated we might be trending in a positive direction.

On the other hand, rep optimism for May isn't increasing after last week's metrics. Deals created experienced a slight decline, staying essentially flat.

Contact growth is also down 14% across all portals last week. Businesses with 26-200 and 201+ employees saw 31% and 25% drops, respectively, while companies with 1-25 experienced a 24% increase and now sit 22% above pre-COVID averages. Smaller businesses noticeably outperformed their larger counterparts in marketing email sends, and with open rates continuing to be at an outstanding high, this could explain why contact growth was so strong for 1-25 businesses last week.

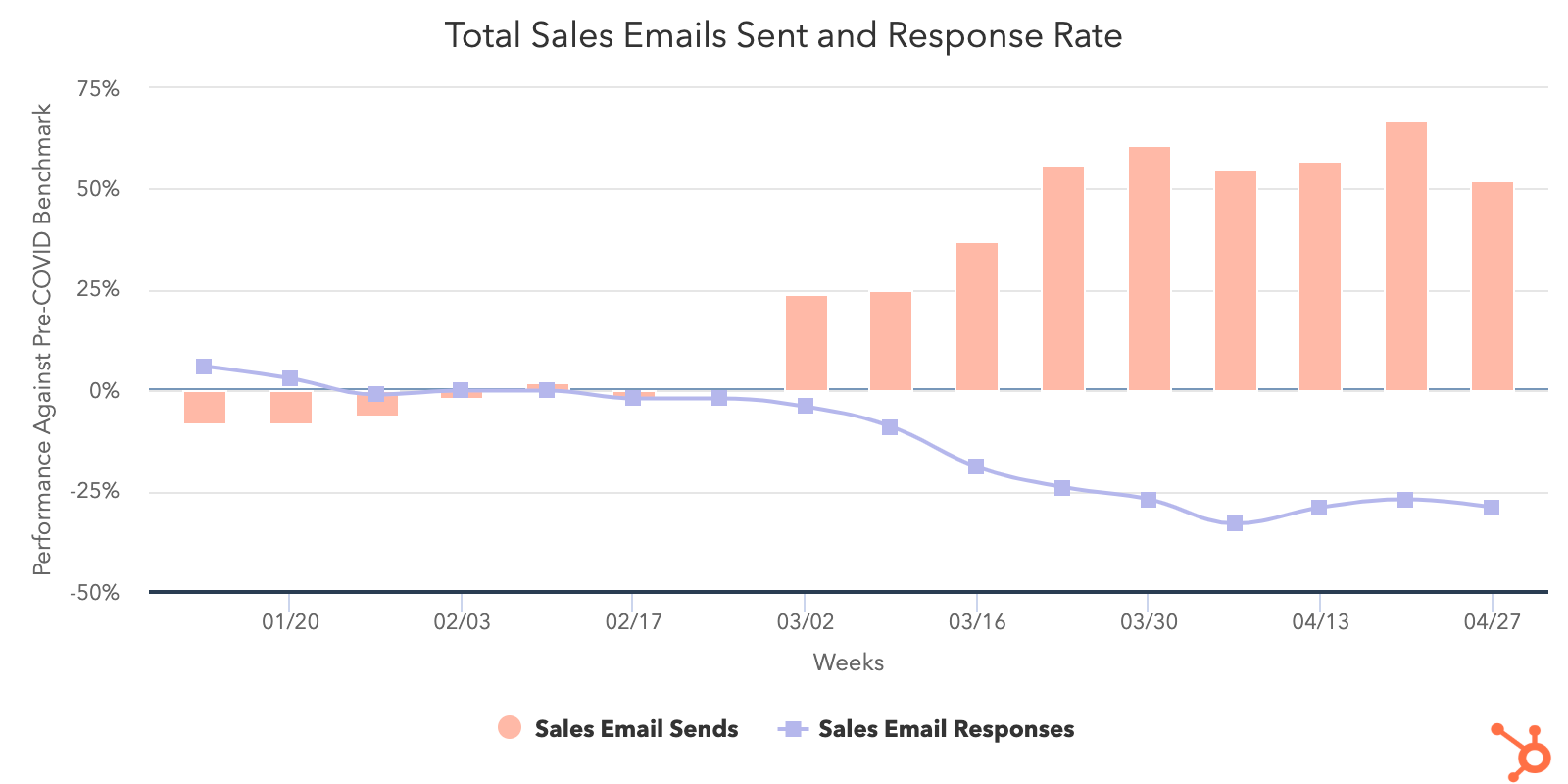

During the week of April 27, the number of sales emails sent from portals dropped 9%, but email send rates are still above pre-COVID levels. Total email responses remained far below pre-COVID rates.

While companies with more than 201 employees actually saw an increase in total sends during the week of April 27, they also saw the biggest decrease in their response rates with a -10% drop, while 1-25 and 26-200 had smaller dips at only 1% and 3%. This, coupled with a decrease in deal creation rates for companies with over 201 employees, suggests that the increase in sales activity did not successfully result in business generation.

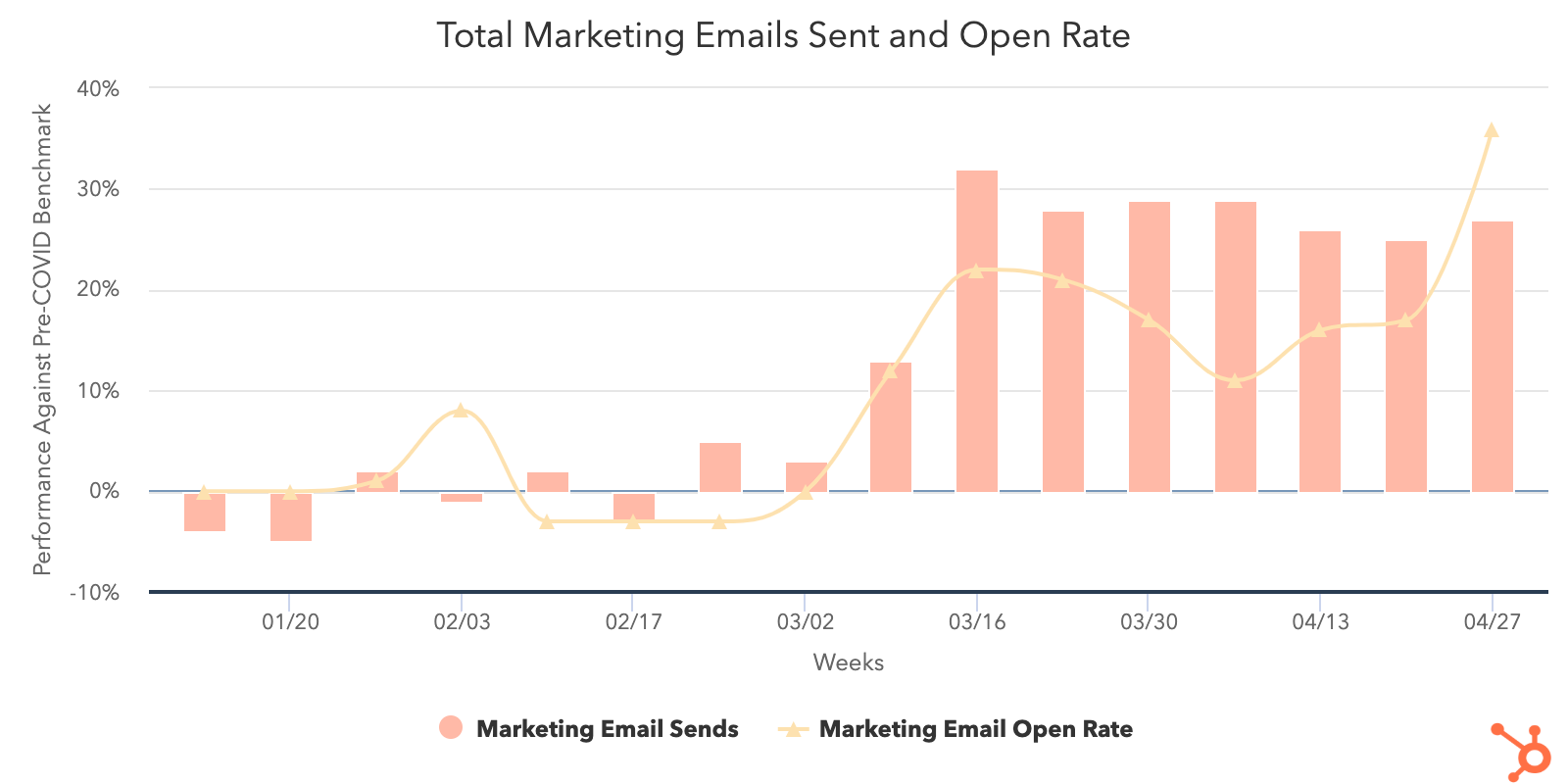

Much to our surprise, open rates on marketing emails continue to rise. Even as marketers sent 27% more emails than they then did pre-COVID, engagement remains strong as we move towards May. We've been expecting to see open rates decline as consumers grow wary of marketing emails, but the data indicates that hasn't happened yet.

Total marketing email sends are up 2% last week. Total open rates continue to rise for the fourth week in a row and are up 3% compared to April 20. As open rates continue to remain strong, companies of all sizes are really leaning into email as a channel to effectively connect with customers.

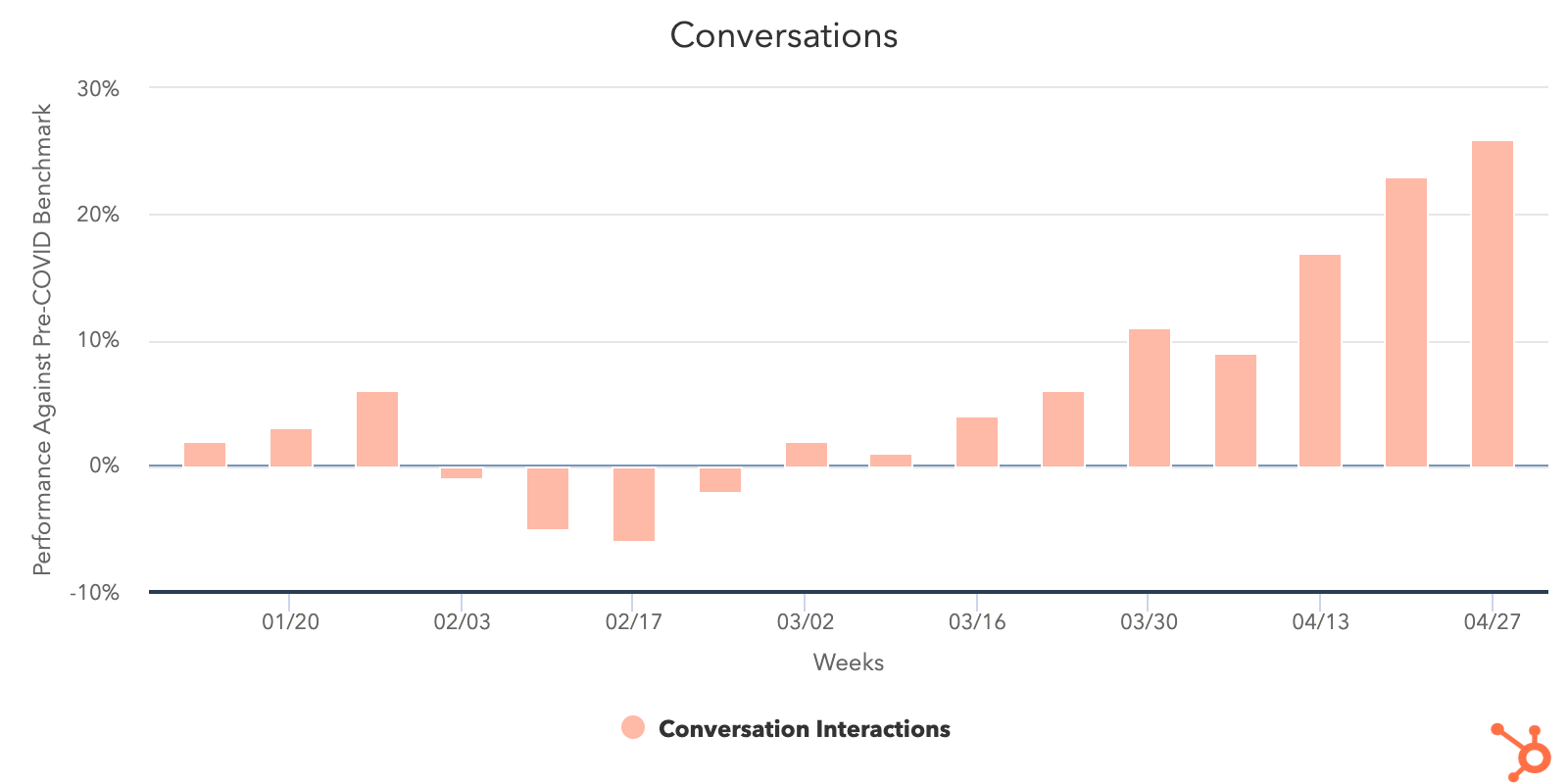

Web traffic remained mostly stable across all portals. The good news is that active conversation interactions, like messaging and live chat, continue to increase, currently performing 26% above pre-COVID weekly averages. The strongest trends were seen in companies with 1-25 employees and in the NORTHAM region.

2. Industries can be categorized into two groups: less-impacted and more-impacted.

Less-Impacted Industries

Despite all industries experiencing a dip in deal creation, there are a few standouts that seem to be faring better than others. This may be due to these industries having been deemed "essential," and/or haven't been as affected by COVID restrictions. We'll keep a close eye on them moving forward and see what they're doing to stay ahead of the curve.

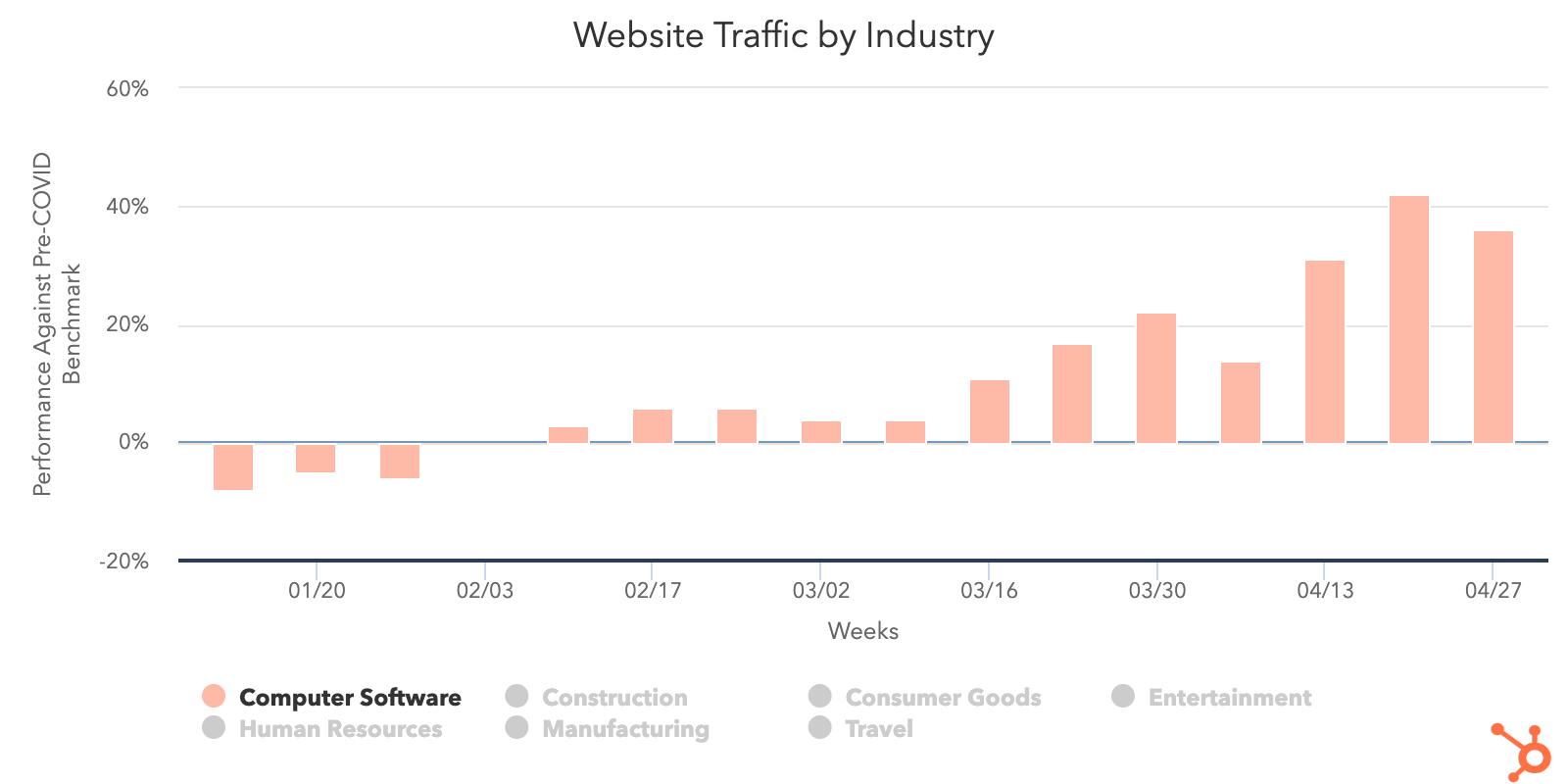

Computer software is one of the best performing industries in terms of deals created, despite seeing an 8% decline last week. Though not as high as construction, its sales email volume remains steady and — with the exception of entertainment — response rates for this industry have suffered the smallest decrease from pre-COVID numbers. This is because website traffic is trending well above pre-COVID averages as consumers are turning to software to help them weather the storm.

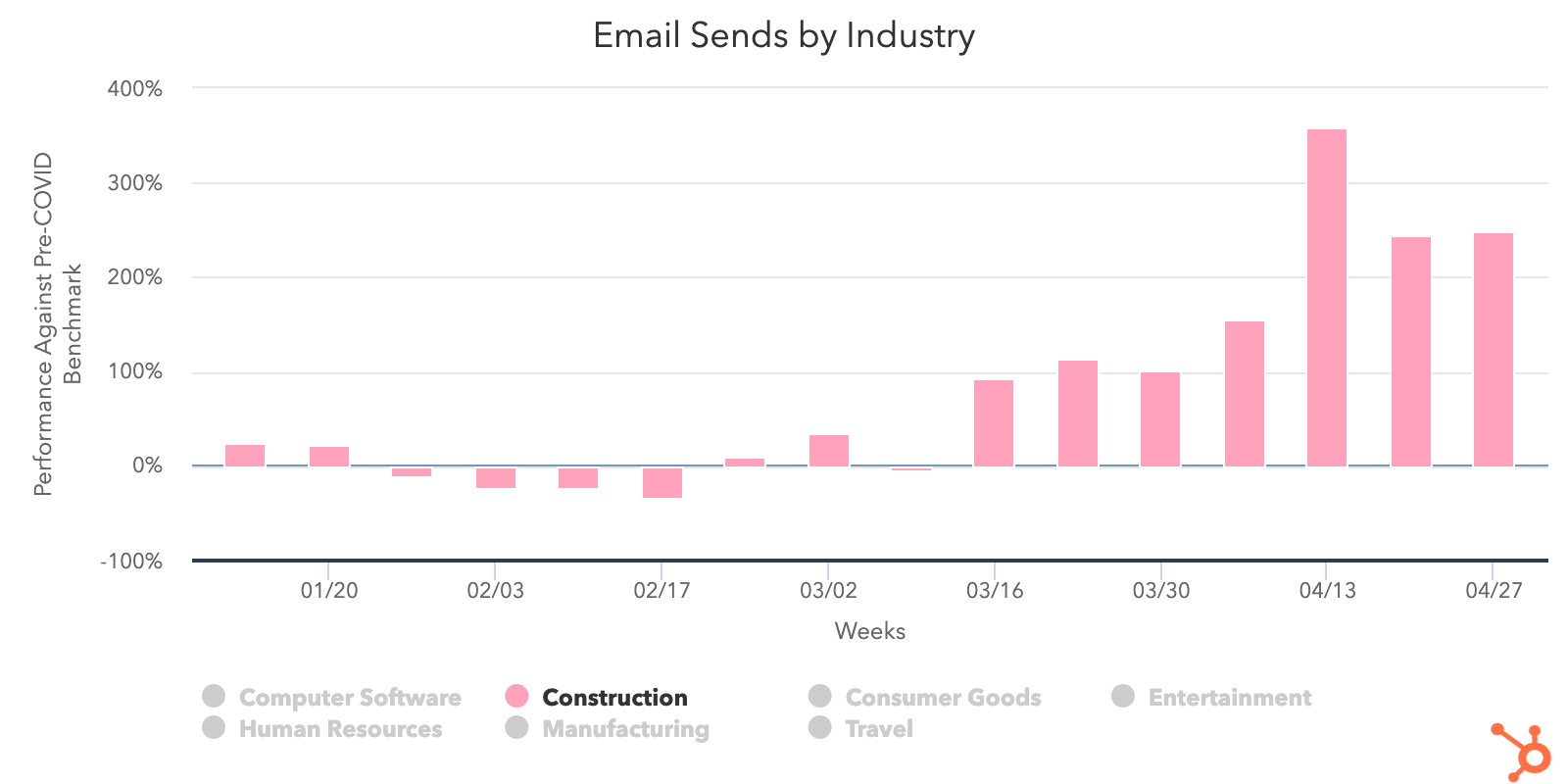

Another standout is construction as many companies in this industry have continued operations under essential work permissions. Construction is only 1% below the benchmark for deals created and has seen a 13% increase in deals closed since the beginning of April.

The volume of sales emails sent for construction is exceptionally high (248% above benchmark the week of April 27) however, its response rates remain below pre-COVID averages. And, with web traffic increasing 5% last week, it's becoming increasingly important for construction companies to communicate with new and long-standing clients as they navigate through uncertain times.

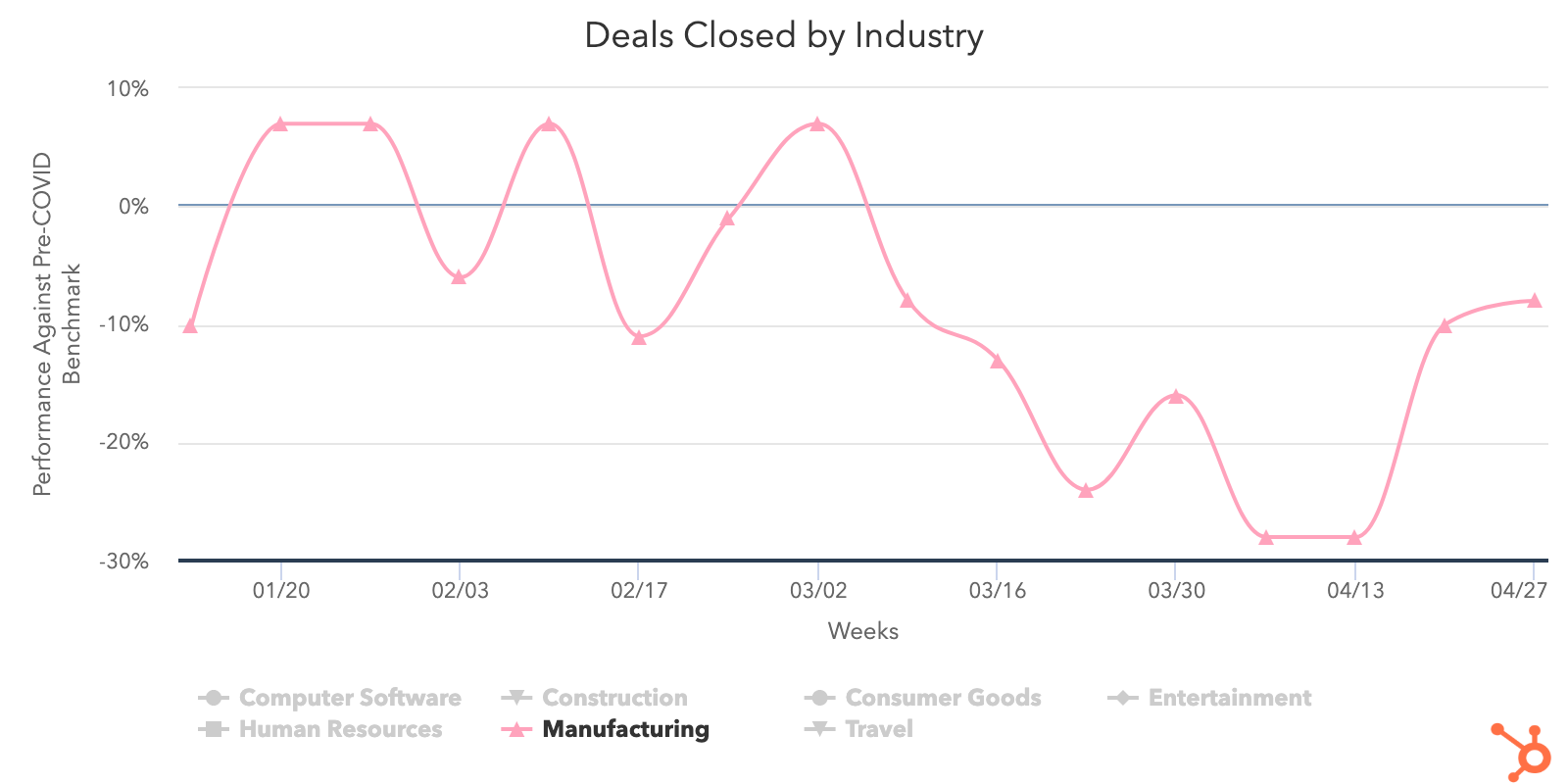

Manufacturing is another industry that's been deemed essential and is permitted to operate in most countries. This explains why its deals created is only 7% below the pre-COVID benchmark and deals closed has risen 28% in the last two weeks. Similar to construction, manufacturers need to be constantly updating their long-term clients, which is why sales email sends for this industry have doubled since pre-COVID and why response rates have dropped so dramatically as well.

More-Impacted Industries

Some industries by default are facing more challenges than others in the battle against COVID-19. Some are subject to restrictions that affect their sales process, some are working tirelessly to attract new leads, and others simply can't open their doors until the local legislature permits them. These are the industries we want to keep a close eye on so we can provide valuable insights that help them overcome roadblocks where we can.

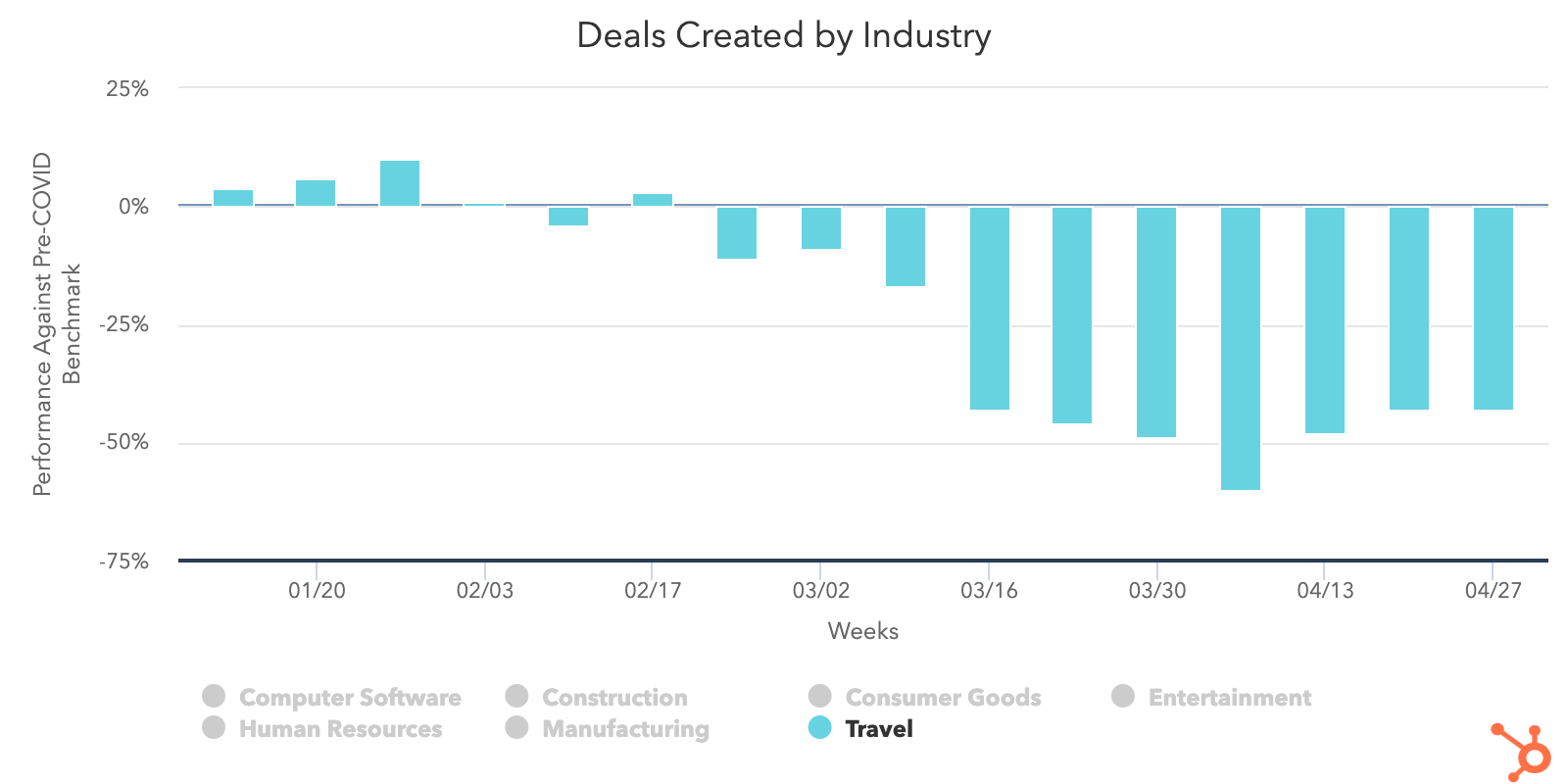

Sadly, travel is one industry that's been the hardest hit across all of the metrics we've recorded. It's seen a huge decline in deal performance, standing 43% below the benchmark for deals created and 29% below for deals closed. Web traffic is down 19% percent since pre-COVID and Inbound demand has dropped off. Not to mention, outbound efforts by reps to engage new leads have struggled as well.

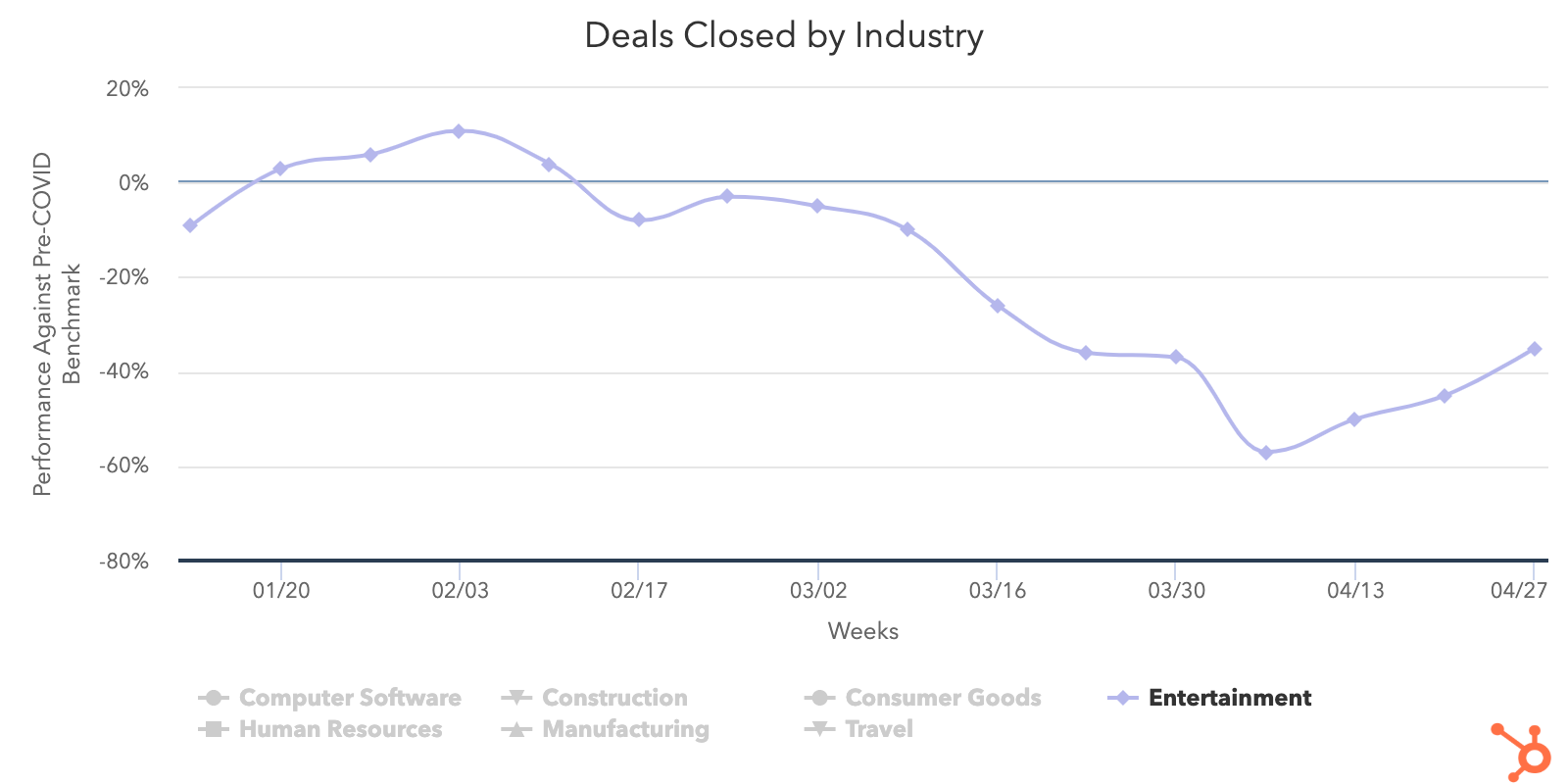

Another industry that's been heavily affected over the past few weeks is entertainment. Entertainment saw a 10% dip in deals created last week and its deals closed is trending 48% below pre-COVID levels. This drop comes after an 8% week over week decrease in sales email responses after increasing email volume by 13% the week of April 27. Even though web traffic and marketing email open rates remain strong, sales teams continue to struggle as entertainment businesses find ways to adapt until they can return to normal strategies.

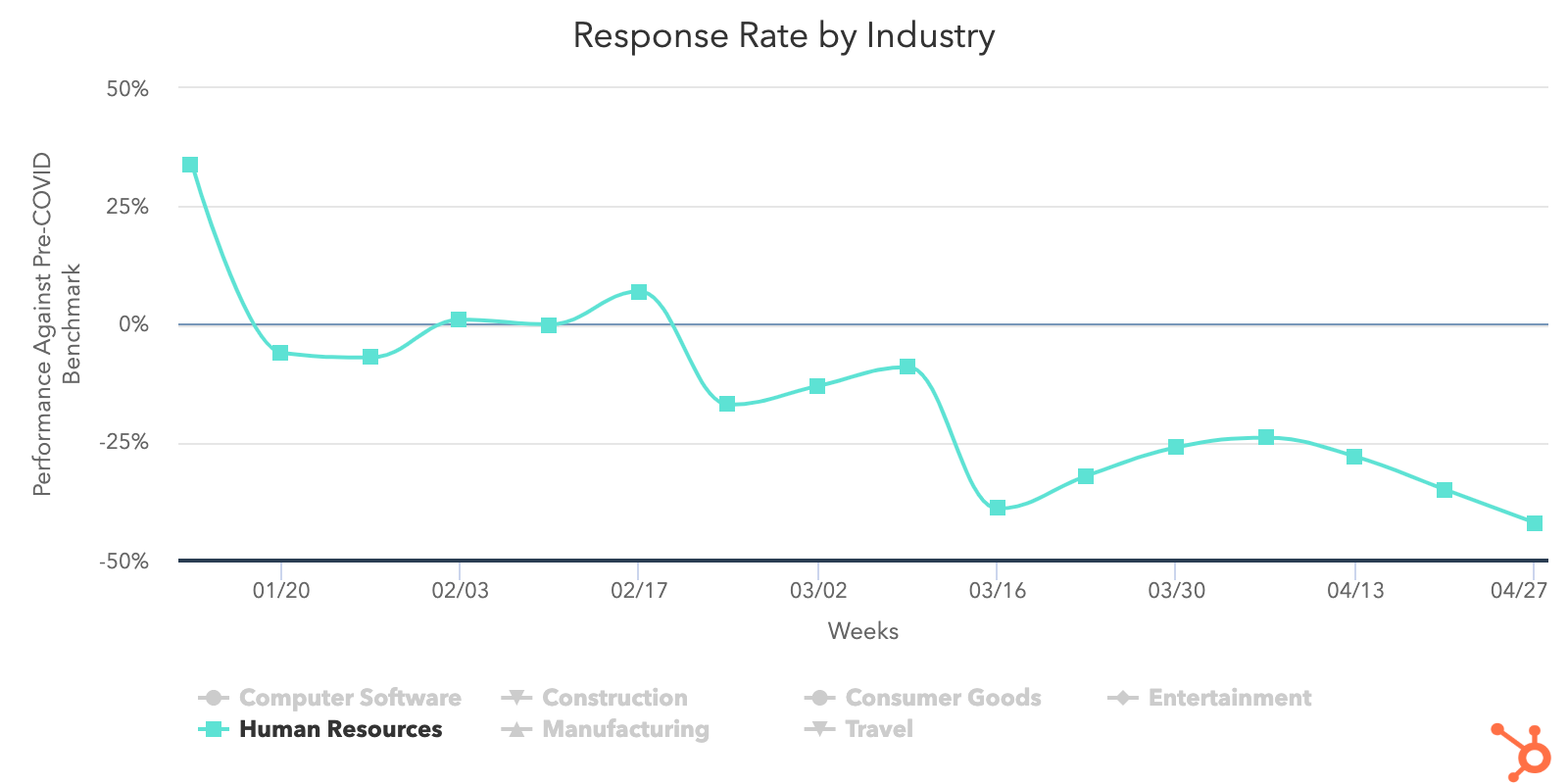

Despite working to reinvent itself quickly, the human resources industry is one of the lowest performers for deals created dropping 18% last week. Sales responses have also reached new lows, sinking 10% and reaching its lowest recording since the week of March 16. While marketing email send and open rates are up, web traffic continues to fall below pre-COVID levels as human resource companies shift focus to building their lead pipelines while businesses aren't currently hiring at a rapid pace.

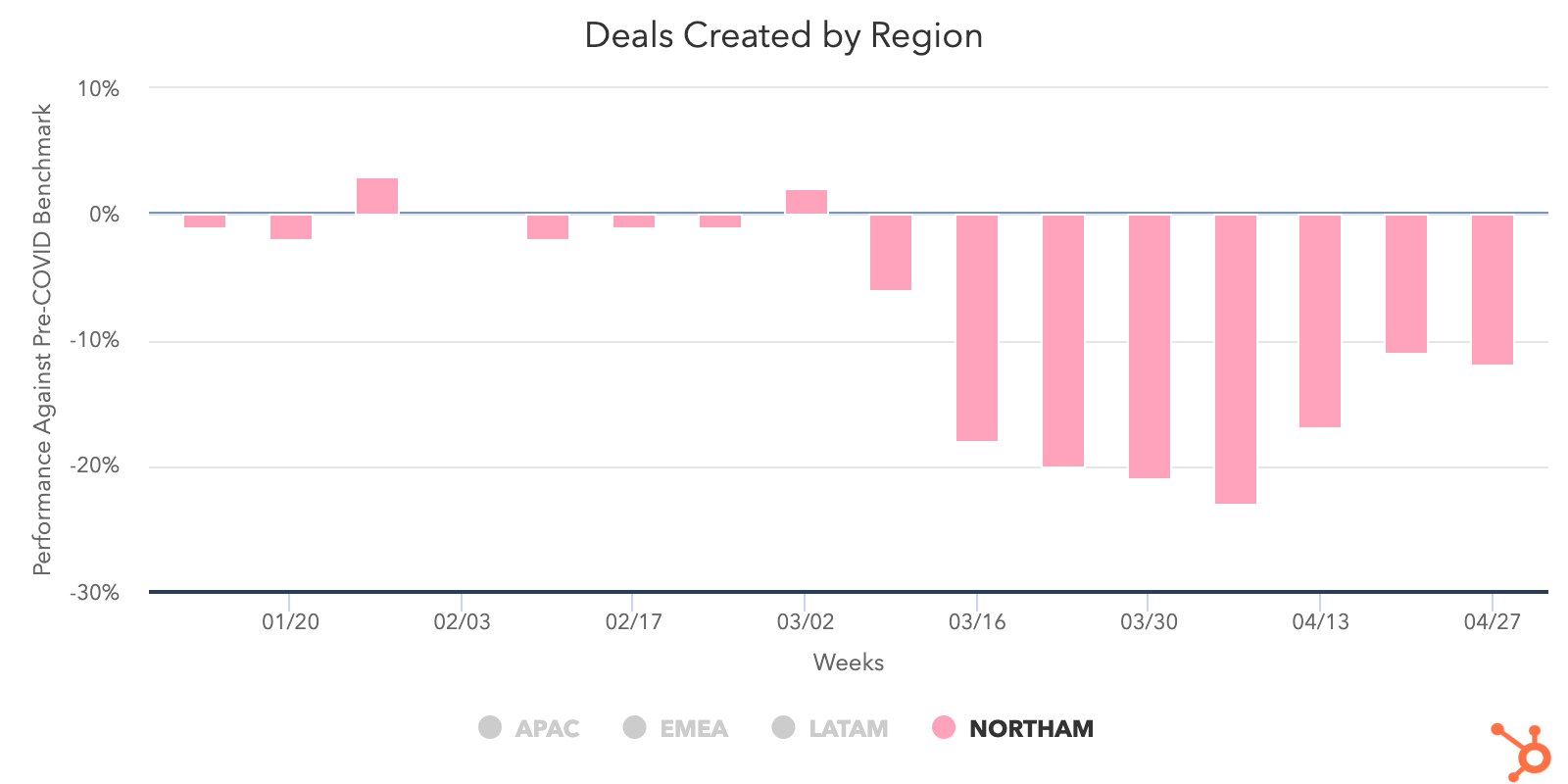

3. NORTHAM's sales metrics hold steady, while EMEA trended the opposite direction.

Regionally, deal metrics favored NORTHAM last week as it was the only region that avoided a decline in deal creation. EMEA recorded the largest drop at 7%, while APAC decreased by 2% and LATAM by 3%. EMEA was also the only region to decline in deals closed, dipping 3% the week of April 27. This can be compared to NORTHAM with a 10% growth, LATAM with 5%, and APAC with 4%.

Germany had a notable drop in deals created (-22%) after experiencing a 41% boost the week of April 20. It also saw a 15% dip in deals closed as that metric slipped to 17% under pre-COVID averages. This could be related to the overall 11% drop that EMEA countries like Germany, Spain, and Italy experienced during the course of last week.

Australia, on the other hand, continued a 4-week streak with a 7% increase in deals created, pushing to just 5% below the pre-COVID benchmark. Deals closed are up 5% week over week and contact growth is up 103% since April 6. That's important to note, too, as APAC dropped 40% as a region in terms of contact growth, second only to LATAM which declined 48% last week.

Narrowing in on the NORTHAM region, Canada had a 15% increase in deals closed, the biggest positive change for any country we recorded last week. The United States is now working on four steady weeks of increases, as it's deals closed is 11% below pre-COVID averages after a 7% bump last week. NORTHAM was also the only region that didn't experience a drop in sales email response rate as every other region dropped by at least 5%.

What This Means for Businesses

Transition from outside sales to inside sales.

The last few weeks have doubtless been a time of tremendous change for companies that employ an outside sales model. Temporarily adjusting to an inside sales model is virtually a requirement for businesses hoping to maintain or grow.

In times like these, knowing how to build strong relationships remotely is key. Invest in videoconferencing software to have "face-to-face" conversations online, and build trust by starting conversations with educational content instead of a generic pitch.

Ensure the quality of your sales conversations doesn't suffer by taking essential parts of the sales process online. Whether it's training your sales teams on cloud communications so they're able to call prospects without physical phones, working with your marketing team to digitize educational content that prospects use to research your products, or learning how to conduct demos online, you'll need to create online equivalents for formerly offline processes. And of course, you'll need the right tools to keep your sales team running -- see below for a dedicated analysis of the technology your team needs.

The last piece of the puzzle is integrating sales enablement with your inside sales engine. Build workflows that ensure the right information is reaching your sales team and that they can easily access it, whether it's through a project management platform, team wiki, etc.

Resources to Help

- Learn to run an online demo with this list of do's and don'ts.

- Transition your sales process online with this sales kit.

- Learn best practices for sales enablement in this certification.

Improve prospecting with targeted, creative outreach.

Our data shows that historic numbers of buyers are visiting and engaging with businesses. Yet we haven't seen a corresponding increase in sales volume. Why?

Part of this decline was inevitable. Companies across the world are tightening their belts and cutting down on nonessential investments. But that can't fully explain historic lows in sales engagement.

The answer lies in prospecting -- the root of most good and bad sales outcomes. The huge increase in email prospecting accompanied by decreases in responses is both troubling and revealing. Instead of maintaining their standard balance of activities, sales professionals are prioritizing the technique that allows them to touch the largest number of prospects in the least amount of time. Not only has this change had the opposite intended effect, it may also hamstring salespeople who find they've burned through their database by blasting irritating emails to prospects who may have been a good fit down the line.

It's time to get back to basics. Buyer interest is at historic highs, and sales teams that take the time to target buyers who have expressed interest in their products will be better at capturing their interest than teams who are merely emailing as many people as possible.

Encourage your sales team to add a human touch to outreach. For example, recording personalized videos to attach to email messages is a way to stand out in crowded inboxes. Leading with relevance and empathy is more important than ever, and incorporating personalization into your outreach process will drive sales teams to slow down and focus on good-fit prospects.

Resources to Help

- Refresh your email outreach with these sales templates.

- Start using video in your sales outreach to engage more prospects.

- Use this guide to increase your sales close rates.

- Lead with empathy in sales emails to build rapport and increase response rates.

Remove friction from your sales process with the right technology.

Friction is never good. But in an economic downturn, friction can be deadly. Our data shows that record numbers of buyers are turning to company websites and chat to conduct research. There are a number of ways you can remove friction from your sales process to form more connections between these prospects and your sales team.

Automate and digitize interactions that formerly took place in person. Many steps of the sales process that used to happen face-to-face will need to move online. Chatbots are a useful way to automate parts of the qualification process. Invest in self-service resources like pre-recorded demos, and ensure your sales team has the right technology to add a human touch to email outreach, and run sales calls online.

Invest in conversational marketing. Conversational marketing offers a real-time way to answer customer questions and automates the lead routing process so your business can serve prospective and existing customers even when your team is out of the office. Additionally, chatbots can help your company meet the increase in inquiries by providing customers with lightning-fast answers, automating lead qualification, and booking meetings on behalf of your sales and service teams.

Enable self-service. Whether it's through chatbots, online meeting booking, eSigning, or self-service meetings links, implementing technology that allows prospects to engage with your business on their schedule will make the process easier on your prospects and more efficient for your team.

Resources to Help

- Equip your team with these essential inside sales technologies

- Streamline your sales process with this guide to frictionless selling (and this course)

- Check out what HubSpot's app partners are offering at this time with this list of relief initiatives

Free Software to Get Started

- HubSpot CRM is free and comes with included sales acceleration tools, including free 1:1 video, meetings, and chatbot tools

- Gmail and Google Calendar integrations with HubSpot

- Zoom integration with HubSpot

- LinkedIn Sales Navigator integration with HubSpot

from Marketing https://ift.tt/2YGXULt

No comments:

Post a Comment